Meet the First BCH Dex Built on Smartbch — Benswap.cash Presents High-Yield Liquidity Pools, Noncustodial Swaps

Meet the First BCH Dex Built on Smartbch — Benswap.cash Presents High-Yield Liquidity Pools, Noncustodial Swaps

Decentralized finance (defi) has set a trend during the latter half of 2020 and into this year, as statistics show $168 billion is locked in defi across various blockchains. The Bitcoin Cash network now has the Smartbch protocol and in recent times, a decentralized exchange (dex) platform has joined the defi fray. The newly launched Smartbch dex platform benswap.cash gives users the ability to earn via liquidity pools, and swap tokens in a noncustodial fashion.

Bitcoin Cash Supporters Flock to Benswap.cash for 1,000% APY and Decentralized Trading

Five months ago, the BCH community anticipated the benefits of a project that combines the forces of Bitcoin Cash (BCH) with the Ethereum (ETH) network. The project is called Smartbch, a smart chain that maximizes the throughput of EVM and Web3 on a sidechain of Bitcoin Cash.

Smartbch has matured quite a bit since Bitcoin.com News reported on the project successfully launching three nodes. Now BCH community members have been leveraging a dex trading platform called benswap.cash, a clone of the dex benswap.finance.

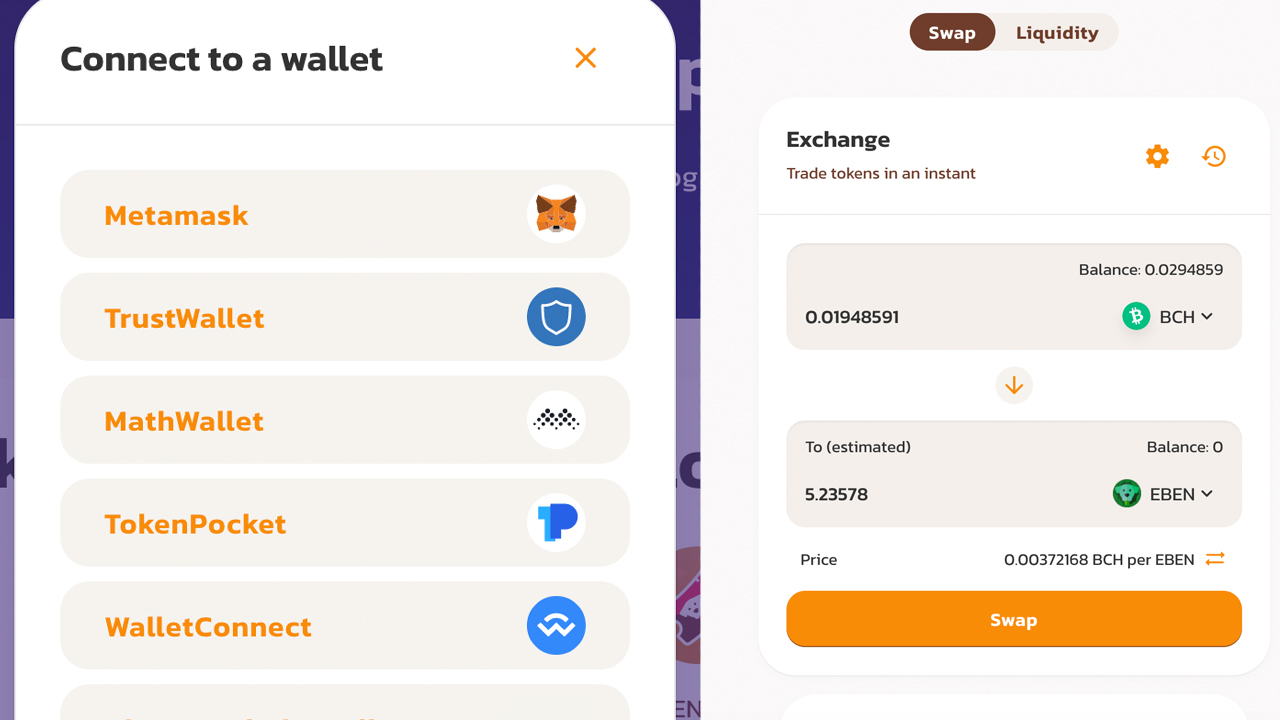

Basically, the ability to earn yields and swap tokens in a noncustodial manner is now possible using bitcoin cash (BCH), the Smartbch sidechain, the SEP20 token protocol, and benswap.cash. The dex benswap.cash operates similarly to swapping platforms like Uniswap, Pancakeswap, and Sushiswap. In order to leverage benswap.cash you will need a wallet like Metamask to interact with the Smartbch network and connect with benswap.cash.

A Comprehensive Guide for Smartbch Newbies, Leveraging the Coinflex Bridge and the ‘Green Ben’ Token

In order to get started, there are a few prerequisites, which are explained in comprehensive detail in a guide posted to the blogging site read.cash. The Smartbch for newbies walkthrough written by “Moregainstrategies” shows the reader how to configure Metamask to work with the Smartbch network.

Furthermore, the blog post explains that for the time being, the only bridge to access sBCH is via the trading platform Coinflex. Because sBCH is required, anyone looking to test the network’s capabilities must swap bitcoin cash (BCH) for sBCH. The only cost a person will pay when swapping BCH over to the SEP20 token sBCH will be BCH network fees.

Coinflex only requires an email address to register, however, a person can also simply use Metamask and avoid registration. After the account is registered or tethered to a Metamask wallet, the user needs to deposit bitcoin cash (BCH) into the Coinflex wallet. After the funds have been confirmed, the user can withdraw but instead, they need to withdraw sBCH using the SEP20 standard.

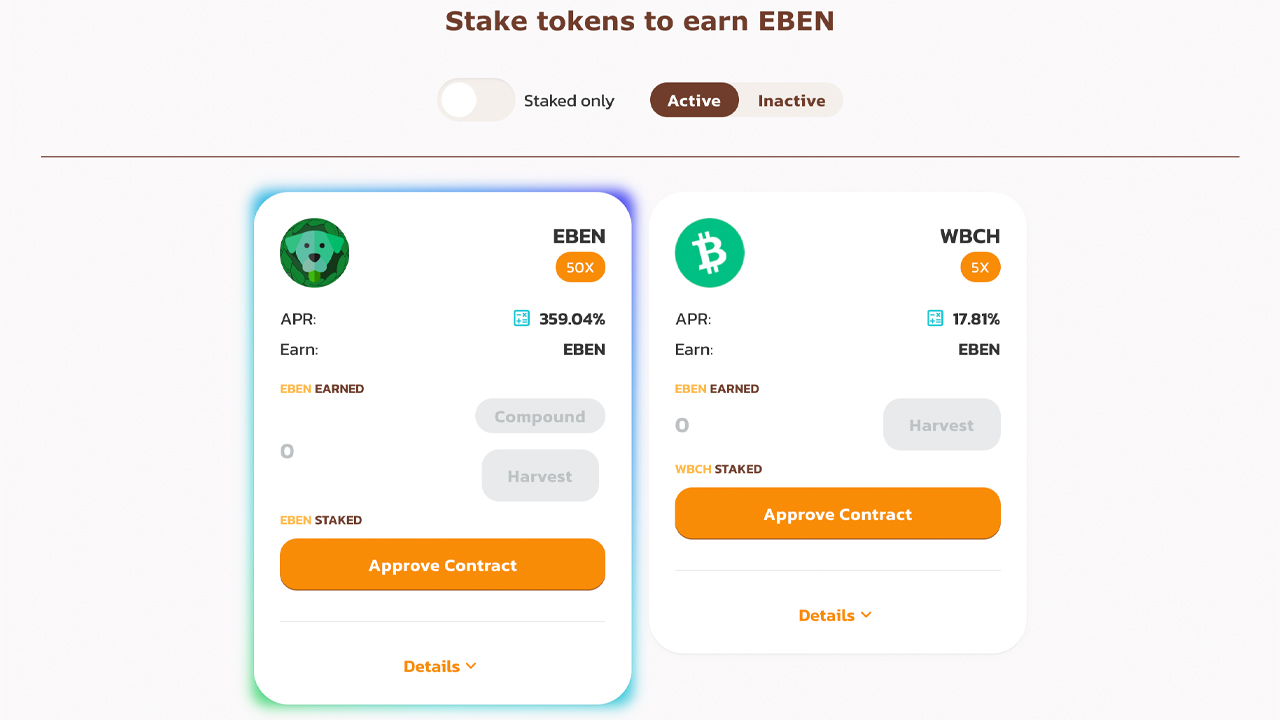

The Metamask wallet address is the address needed to send the sBCH to, and after a small wait, the sBCH should arrive in the wallet. From here, benswap.cash can be used to either swap Smartbch tokens or join a yield farm in order to gather passive income from their liquidity tokens. For instance, on the benswap.cash platform there is a section where swaps can happen for Smartbch tokens like “$cats,” “arg,” “green ben,” “honk,” and more. The token green ben (EBEN) is the native token for benswap.cash and is also leveraged for governance decisions.

At the time of writing, a single green ben (EBEN) is trading for $2.4826019 per EBEN and there is a circulating supply of 5,723,529 EBEN today. The price per EBEN and the number of tokens in circulation give the coin a market cap of around $14.2 million. In addition to being able to swap tokens in a noncustodial fashion, users can stake LP tokens to earn EBEN via liquidity pools.

Current Smartcash Farms Show Yields Between 200% and 1,000%+ APY

The current annualized percentage yields (APY) for benswap.cash liquidity pools are quite high. For instance, the EBEN-BCH liquidity pool at the time of writing gives a user 1,070% paid in EBEN, minus fees. There’s also the $CATS-BCH and $CATS-EBEN liquidity pools which have current APYs between 210% and 290%. It should be noted that APYs hosted on benswap.cash can fluctuate like the myriad other dex applications that offer liquidity pools.

It should also be noted that benswap.cash is a clone of the BSC dex benswap.finance, which is in the midst of being audited by Certik Security. This means the audit is not yet complete; all dex applications come with risks, and users should leverage due diligence and make sure their wallet’s network settings and token contracts are not malicious or falsified. The creators of the benswap.cash project are also unknown and the protocol is only a few months old.

Audited or not, traders should never invest more than they are willing to lose on any dex application. Following the first Smartbch guide written by “Moregainstrategies,” the author published another article covering the benswap.cash dex. The post explains the risks involved with the new dex and the pros and cons people should be aware of while researching the exchange.

Bitcoin cash fans have been discussing the benswap.cash dex regularly on the forum r/btc and on Twitter. The r/btc Reddit forum has a number of posts that discuss how benswap.cash works and that it’s the first dex to build on top of the Bitcoin Cash (BCH) network.

What's Your Reaction?